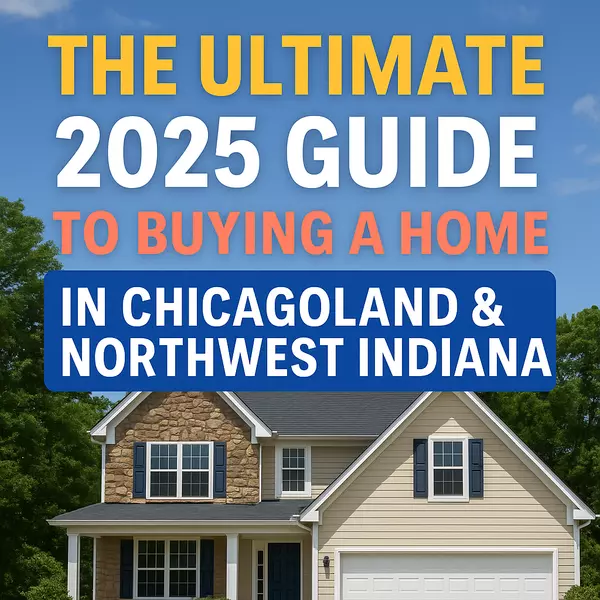

First-Time Homebuyer’s Guide: How to Buy Your First Home in 2025

First-Time Homebuyer’s Guide: How to Buy Your First Home in 2025

Buying your first home is an exciting milestone, but it can also feel overwhelming if you don’t know where to start. From understanding financing options to closing on your dream home, this guide will walk you through every step of the home-buying process.

1. Check Your Credit Score & Get Pre-Approved

Your credit score plays a crucial role in determining your mortgage eligibility and interest rates. Before house hunting, check your credit report and work on improving your score if needed. You can monitor your credit with free resources like AnnualCreditReport.com.

Once you’ve reviewed your credit, it’s time to get pre-approved for a mortgage. A lender will assess your financial health and give you a pre-approval letter, which strengthens your offer when you find a home you love. Learn more about mortgage pre-approvals at Freddie Mac.

2. Determine Your Budget & Explore First-Time Homebuyer Programs

Knowing how much home you can afford is essential. Use online mortgage calculators like Bankrate’s Mortgage Calculator to estimate your monthly payments.

You may also qualify for first-time homebuyer assistance programs that offer down payment help, lower interest rates, or tax credits. Check out available programs in your state through HUD’s Homebuying Assistance Programs.

3. Find the Right Real Estate Agent

Working with a knowledgeable real estate agent can make the process smoother. An experienced agent will help you find homes within your budget, negotiate the best deal, and guide you through paperwork. Explore top-rated agents and listings at RealEstateUSA.com or connect with experts at Realest.com.

4. Start House Hunting & Make an Offer

Once you have a budget and pre-approval, start searching for homes that fit your criteria. Websites like Realtor.com and Zillow provide up-to-date listings.

When you find a home you love, your agent will help you submit a competitive offer. In today’s market, bidding wars are common, so being flexible with contingencies can give you an edge.

5. Get a Home Inspection & Appraisal

Before finalizing your purchase, schedule a home inspection to uncover potential issues. A professional inspector will assess the home’s structure, plumbing, electrical, and more. Find certified inspectors at The American Society of Home Inspectors (ASHI).

Your lender will also require a home appraisal to confirm the property’s value before approving your mortgage.

6. Close on Your Home & Get the Keys!

Once your loan is approved and all contingencies are met, it’s time to close. During the closing meeting, you’ll sign all necessary paperwork, pay closing costs, and receive the keys to your new home.

Final Thoughts

Buying your first home doesn’t have to be intimidating. With the right knowledge and support, you can confidently navigate the process and find the perfect place to call home.

Looking for expert guidance? Browse listings and connect with experienced real estate professionals at RealEstateUSA.com and Realest.com to start your home-buying journey today!

Categories

- All Blogs (50)

- buyers (6)

- Community & Lifestyle (5)

- first time buyers (8)

- Home Buying Tips (5)

- Home Selling (1)

- homebuyers (6)

- Homeownership & Maintenance (1)

- Join Realest (4)

- Listings (14)

- Local Market Insights (6)

- real estate (11)

- real estate agent (10)

- Real Estate News & Trends (2)

- sellers (5)

- selling (3)

Recent Posts